Tyme Bank

Lead Product Designer

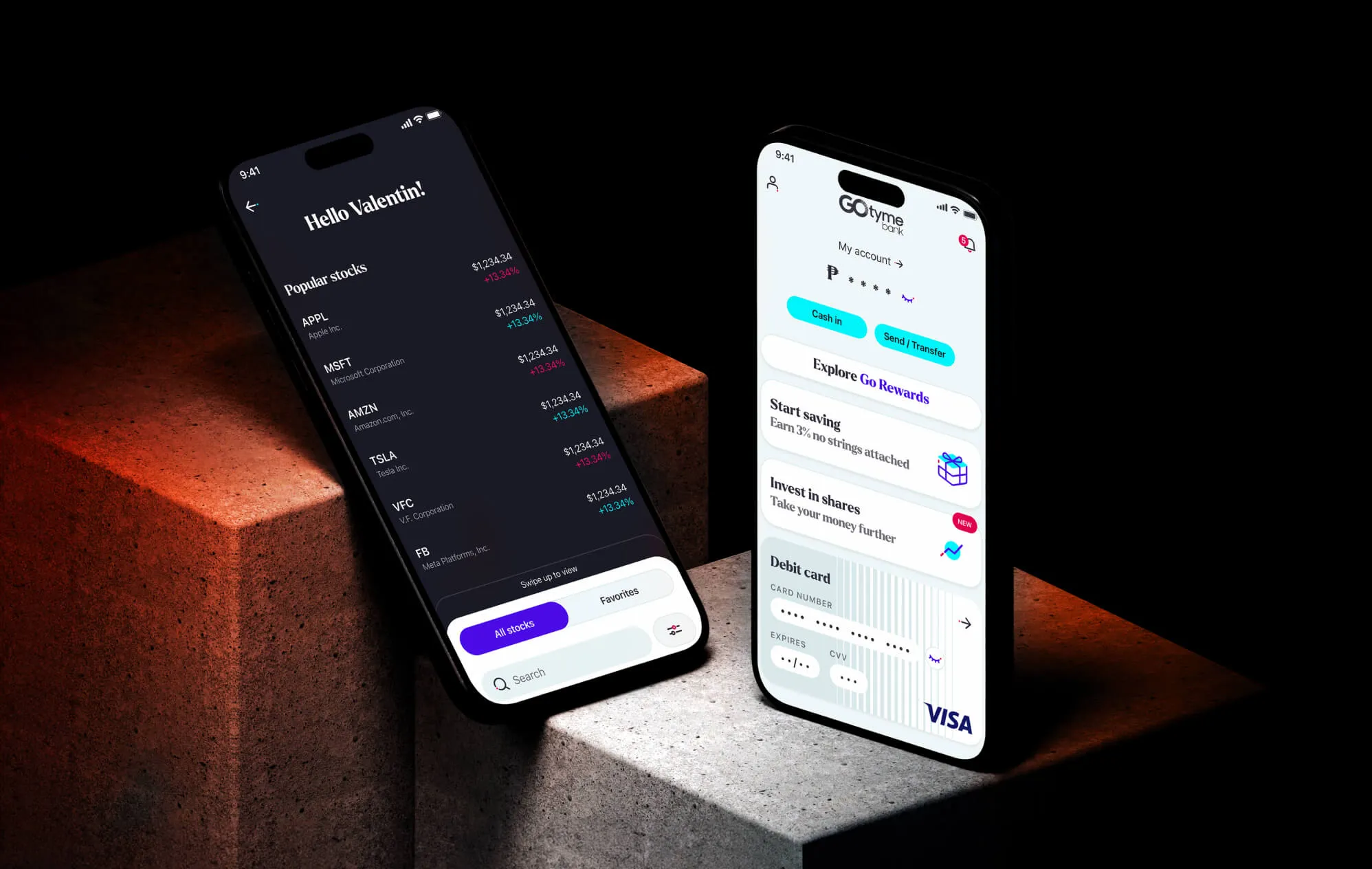

Bank Mobile Application

3.7 million user

600% YoY Growth

250k avg user gain per month

© 2021

(Scroll down)

(Intro)

I joined the team as Lead product designer and worked on their financial investment product suite, in particular fractional shares

Summary

What are Fractionnal Shares

Fractional shares are shares of equity that is less than one full share.

For GoTyme, we started with US Stocks but the feature was supposed to be scalable into different products ( filipino stocks, crypto etc. )

Where we started

We started to look at our userbase, what problem they were facing, why would they invest, what frequency and in what manner, how they managed risk and loss.

We researched various competitors in the investment industry, looking at features and application, finding best practices and how to best simplify the experience.

Problem statement

Current customers don’t have the capacity to invest their money at GoTyme.

Opportunities

There was an opportunity for us to learn about filipino investment behaviour as well as pushing for the simplest possible solution. How can we make make investment easy?

My Responsibilities

As the Lead on this project I was responsible for overseeing the end-to-end design process including user research, validation of studies, documenting solutions, leading high quality UI designs and design system contributions, developing a detailed project plan to monitor and track progress, and working closely with cross-functional teams to ensure that the design aligns with GoTyme’s goals and objectives as well as our overall design strategy

Desired Outcomes

By giving users a simple and smooth investment feature, we hope to boost retention, daily sessions and revenue through fees; those were our key metrics.

Work process

Using our previous intensive rounds of research and user interviews, we had a pretty clear idea of our target demographic, in line with GoTyme’s core users.

Based on the value compared to our competitors, we decided to place it on the high up homepage, hoping to drive conversion and have a solid selling point for user to choose GoTyme.

Once this was set, we set the whole flowmap, listing out all possible scenarios and edge cases, giving us the full list of pages we would need.

Using this list, we went through the whole information architecture of the feature, page by page, aiming to reduce cognitive load and maximizing efficiency.

This guided use to create a first batch of high fidelity design and aserie of prototype - we ran a first quantitative usability testing, using maze, refined our design, then a second usability testing, qualitative this time, in the Philippines.

Once we were certain of our design, we moved on to animation and micro interaction strategy, wrapping up the project, until we add more features to it, working with engineers to implement the design and add any unseen edge cases.

Outcomes

This constant use of design thinking and thorough testing led GoTyme Bank to reach one million customers nine months after its launch, and four months later doubled that number to finish 2023 with over 2 million customers.

It help us prove that design thinking was a valid way to reach market while reducing costs by using consistent approach and iterations as well as reducing strain due to badly targeted products.

This growth has further accelerated in 2024 with GoTyme Bank adding 1.7 million customers in the first half of the year.